Average Salary of a CPA

Becoming a Certified Public Accountant (CPA) can be a lucrative and rewarding career choice. CPAs are highly respected professionals who provide financial services to individuals, businesses, and organizations. One of the most common questions people have about this career is, “What is the average salary of a CPA?” This article will explore the answer to this question in detail.

A Certified Public Accountant (CPA) is a professional accountant who has met specific education and experience requirements and has passed the Uniform CPA Examination. CPAs provide a range of financial services, including tax preparation, financial planning, and auditing, to individuals, businesses, and organizations.

The Importance of a CPA

Certified Public Accountants (CPAs) play a crucial role in the functioning of the financial industry. Here are some additional details on the essential responsibilities and contributions of CPAs:

Ensuring Accuracy of Financial Records and Compliance with Regulations:

One of the primary responsibilities of CPAs is to ensure that financial records are accurate and comply with regulatory requirements.

They review financial statements and records to ensure they are free from errors, omissions, or fraudulent activities. They also provide independent audits of financial statements to attest to their accuracy and compliance with generally accepted accounting principles.

CPAs are also responsible for ensuring that businesses and individuals pay their taxes correctly and on time. They prepare tax returns, advise clients on tax planning strategies, and represent clients in tax disputes with the Internal Revenue Service (IRS).

Providing Valuable Financial Advice:

CPAs provide valuable financial advice to businesses and individuals. They help clients develop budgets, manage cash flow, and plan for future financial needs. They also advise investment strategies, retirement planning, and estate planning.

CPAs are often called upon to provide financial advice during significant life events, such as starting a new business, buying a home, or planning retirement. They help clients navigate complex financial decisions and make informed choices that can significantly impact their economic well-being.

Contributing to the Growth and Success of Businesses:

CPAs play a critical role in the growth and success of businesses. They provide financial analysis and reporting that helps business owners make informed decisions about investments, expansion, and other strategic initiatives. They also help companies to comply with regulatory requirements and manage risks associated with financial transactions.

CPAs are often involved in the day-to-day operations of businesses, providing financial guidance and support to management teams. They work closely with other professionals, such as attorneys, bankers, and financial advisors, to ensure businesses are well-positioned for growth and success.

What is the Average Salary of a CPA?

The average salary of a CPA varies depending on several factors, including experience, industry, and location. According to the Bureau of Labor Statistics, the median annual wage for accountants and auditors, including CPAs, was $73,560 as of May 2020. However, this number can vary significantly based on the factors mentioned above.

The average salary of a Certified Public Accountant (CPA) depends on several factors, like experience, industry, location, and more. Here are some essential points to note:

• According to the U.S. Bureau of Labor Statistics, in 2020, the median annual wage for accountants and auditors was $73,560. CPAs generally earn more than the median for accountants as a whole.

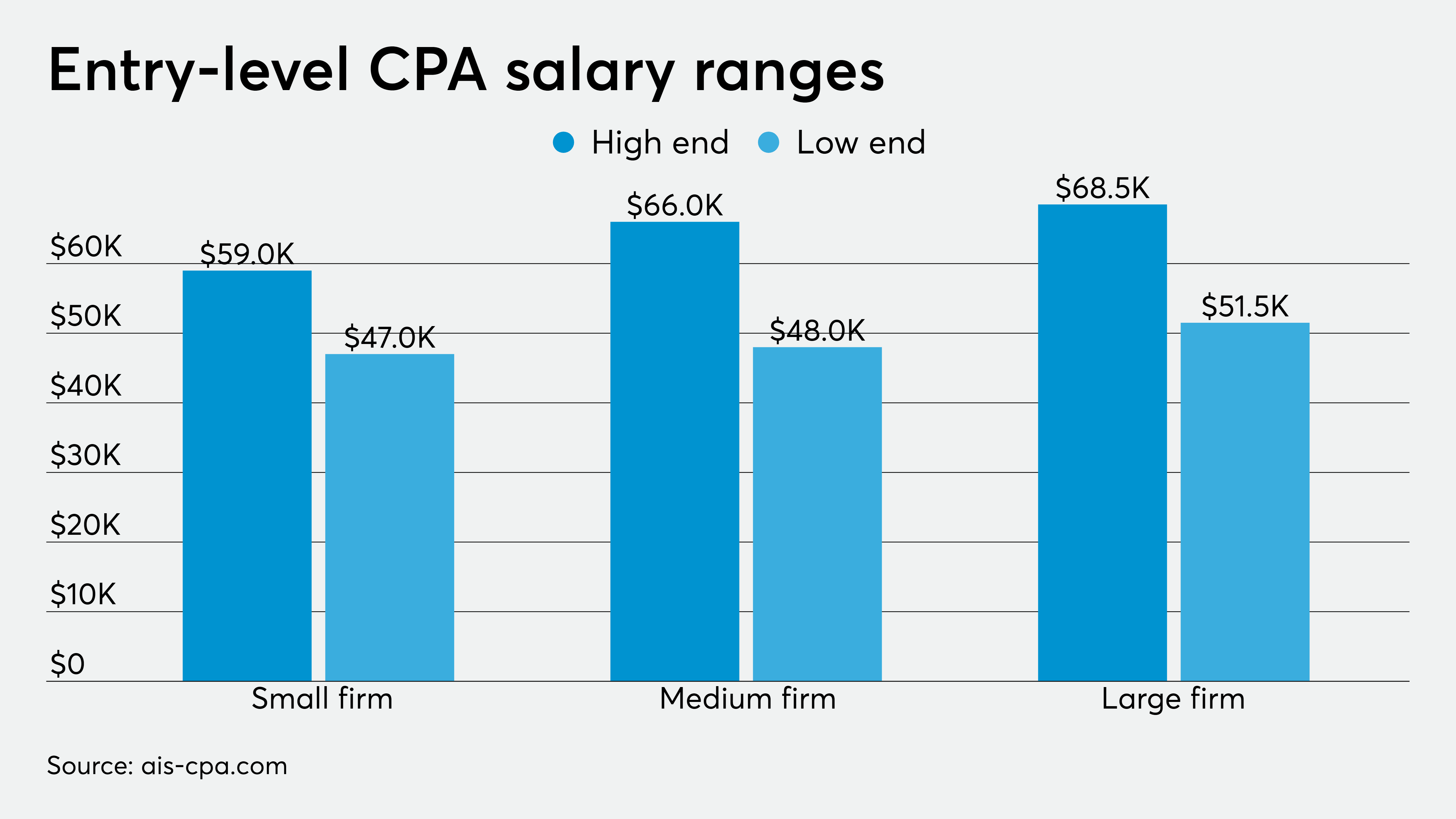

• CPAs with more experience and seniority tend to earn higher salaries. Entry-level CPAs typically earn around $50,000 to $60,000 per year, while senior CPAs can earn over $100,000 annually.

• Industry also impacts CPA salary. CPAs in finance, banking, and consulting generally earn the highest salaries, while those in government and nonprofit organizations tend to make less.

• Location is another factor. CPAs in major cities like New York, Los Angeles, and San Francisco tend to earn more than the national average. The cost of living is also higher in these areas.

• Some CPAs earn bonuses or commissions based on performance, clientele, or profits. This can significantly increase total compensation.

• Benefits like health insurance, retirement plans, and paid time off also factor into a CPA’s total compensation package.

• Self-employed CPAs operating consulting or accounting practices can earn much higher incomes.

The average annual CPA salary ranges between $70,000 to $110,000, depending on experience level, industry, firm size, and location. However, top earners with the most senior roles in high-paying sectors can make significantly more.

Factors that Affect CPA Salaries

Experience: The more experience a CPA has, the higher their salary will likely be. CPAs who have been working in the field for many years can expect to earn more than those who are just starting.

Industry: The industry in which a CPA works can also affect their salary. CPAs in finance and Insurance tend to earn more than those in government or nonprofit organizations.

Location: Where a CPA works can also impact their salary. CPAs in large cities or metropolitan areas generally earn more than those in rural or small towns.

Average Salaries for CPAs in Different Industries

Finance and Insurance: $80,300

Management of Companies and Enterprises: $78,300

Accounting, Tax Preparation, Bookkeeping, and Payroll Services: $73,800

Government: $72,500

Nonprofit Organizations: $67,900

Average Salaries for CPAs in Different States

New York: $101,940

California: $99,300

Texas: $79,590

Florida: $72,300

North Carolina: $70,380

How to Increase Your CPA Salary

Gaining more experience and specializing in a particular area of accounting are great ways to increase your salary as a CPA. Here are some additional detail and creative ideas on how to do so:

Gain more experience:

As mentioned earlier, experience is critical in determining a CPA’s salary. One way to gain more knowledge is by taking on new and challenging projects at work. This helps you develop new skills and demonstrates to your employer that you are committed to your job and willing to take on additional responsibilities.

Another way to gain more experience is by volunteering your services to nonprofit organizations or small businesses. This can provide you with hands-on experience in a different type of accounting than you may be used to and can also help you develop new skills that you can apply to your day job. Volunteering can help you create a network of contacts in your community who may be able to refer you to potential job opportunities in the future.

Specialize in a particular area of accounting:

Specializing in a particular area of accounting can make you more valuable to employers and lead to higher-paying positions. One way to specialize is by obtaining additional certifications in a specific area, such as Certified Financial Planner (CFP) or Certified Fraud Examiner (CFE). These certifications demonstrate to employers that you have a high level of expertise in a particular area and can help you stand out from other job candidates.

Another way to specialize is by focusing your work on a particular industry, such as healthcare or real estate. This can help you develop a deep understanding of the accounting practices and regulations specific to that industry, and can make you more attractive to employers in that field.

Finally, consider developing your soft skills, such as communication, leadership, and problem-solving. These skills can help you stand out as a valuable team member and can lead to opportunities for promotion and salary increases.

Highest paying sectors for CPAs?

Here are the highest-paying industries and sectors for CPAs:

• Finance and banking – Salaries are the highest for CPAs in finance, investment banking, private equity, and asset management firms. This is due to the complexity of the work, long hours, and the high value placed on CPA credentials in these fields. The average CPA salary in finance is over $100,000 and can reach $200,000 or more for senior positions.

• Management consulting – Consulting firms like the “Big Four” (Deloitte, EY, KPMG, and PwC) employ many CPAs and pay competitive salaries. Salaries often start around $80,000 and ramp up quickly with experience. Partners and directors can earn well over $200,000.

• Multinational corporations – Large companies with complex global operations and finances hire CPAs in internal audit, tax, risk management, and accounting. Salaries are often on par with the finance and consulting sectors.

• Public accounting – Most CPAs start their careers at large accounting firms. While base salaries are generally average, bonuses and the potential to make partners can lead to higher compensation long term.

• Self-employment – Becoming an independent CPA, starting your firm, or working as a contractor can potentially provide the highest income depending on the number and size of clients. However, this brings the most risk and instability.

• Technology – Growing companies in the tech sector hire CPAs for finance, accounting, and audit roles. While base salaries may be average initially, stock options and equity compensation can lead to higher overall pay.

Average Salary of a Neurosurgeon?

FAQs

What is the highest-paying industry for CPAs?

The finance and insurance industry is the highest-paying industry for CPAs, with an average salary of $80,300.

What state has the highest average salary for CPAs?

New York has the highest average salary for CPAs, with an average salary of $101,940.

Do CPAs make more than regular accountants?

CPAs typically make more than regular accountants due to their advanced education, certification, and experience.

Is it possible to increase your salary as a CPA?

Yes, it is possible to increase your salary as a CPA by gaining more experience, specializing in a particular area of accounting, and pursuing advanced education and certifications.

Are there any other benefits to becoming a CPA besides salary?

Yes, becoming a CPA can increase job security, more excellent job opportunities, and the ability to work in various industries and settings.

Conclusion

Becoming a Certified Public Accountant (CPA) can be an advantageous and lucrative career choice for those interested in finance and accounting. A CPA is a professional accountant licensed to provide financial services to the public, including auditing, tax preparation, and financial planning. CPAs work in various industries, including government, public accounting firms, and the private sector.

One of the most appealing aspects of becoming a CPA is the potential for a high salary. According to the United States Bureau of Labor Statistics, the median annual wage for accountants and auditors, including CPAs, was $73,560 as of May 2020. However, the compensation of a CPA can vary depending on several factors, including experience, industry, and location.